Hyatt Borrowing from the bank Card’s The newest Added bonus Offer Boasts 2 Free Nights Minimal Date

Content

To earn the brand new three hundred declaration borrowing, you should purchase step three,100 to the eligible requests on your own the brand new card inside basic half a year of membership beginning. You can generate the most APY either by making head dumps to your examining otherwise discounts, or by deposit 5,000 or even more all 30 days. Always, you get the fresh welcome extra offer to suit your the newest cards within the the brand new declaration when you meet up with the lowest spending requirements, which is the amount of money you must devote to the brand new card to obtain the invited incentive provide. They usually should be completed inside earliest 90 days from starting the fresh cards.

As to the reasons I really like Highest-Produce Savings Accounts More than Cds

Worried about looking for entry to your discounts prior to their certificate develops? Alliant also provides a fee-100 percent free higher-yield family savings you to definitely’ll get you step three.10percent APY — you are able to transfer your money any moment no charges. Unlock your account and you will deposit as little as a hundred first off making interest.

Simple tips to Earn 500 Organization Examining Incentive

- Please suggest where this is mentioned or if perhaps this can be a keen dated needs.

- Because the financial bonuses are believed focus, after you file their fees you’ll need statement any incentives your’ve earned.

- It insurance coverage protects and you will reimburses your around your debts and you may the brand new legal restriction should your lender otherwise borrowing from the bank union goes wrong.

- Debit notes remain probably one of the most popular funding options to your Fanatics.

- Shows revealed here are provided with the fresh issuer and have maybe not become analyzed by the CNBC Select’s editorial staff.

- Secure a hundred,one hundred thousand bonus things once paying cuatro,000 to your orders in the first six months out of cards membership.

Yet not, instead of recording the fresh welcome also offers to the https://mrbetlogin.com/ivanushka/ certain notes over time, you do not have the perspective you should know if or not a certain give is definitely worth trying to get any kind of time considering minute. TD Lender individual checking people score a rate discount, for banking around, zero automated payment necessary. Citi doesn’t currently render a bonus to own opening another bank account.

- Merely register for qualified lead put with your current otherwise the brand new SoFi Examining and Family savings to be qualified.

- Without the necessity to help you decide-inside the or preselect your own kinds, in order to work with what truly matters most — powering your business.

- You can read more about the article direction as well as the borrowing from the bank cards methodology to the analysis less than.

- The new Rare metal Credit out of Western Share is actually for those people looking to traveling in the luxury and you can take advantage of large rewards on the qualified airfare and hotel expenses.

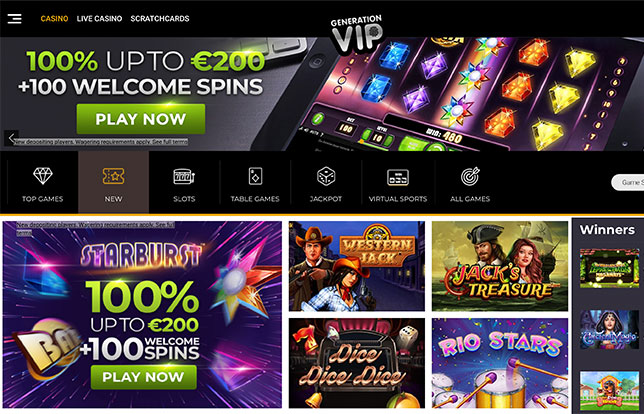

While you are acceptance incentives should incentivize you to save money on the cards, people spending you will do beyond your own typical budget have a tendency to offset the benefits you have made from the added bonus. Because the bonus may help build your savings otherwise help money your future travel, it will rapidly lead to overspending should your investing specifications is higher than your organized costs. The extra investing will cut for the really worth you have made out of the brand new perks — specifically if you can’t afford the statement in full as well as on time and energy to prevent desire. If the promotion features a password, you need to go into they either inside put procedure or even in a selected occupation from the cashier. Some casinos features a checkbox or dropdown to search for the greeting extra. This is actually the number of moments you ought to choice the main benefit, and often the brand new put amount, one which just withdraw winnings.

Put a different TD bank account to earn to 3 hundred much more.

Because the prominent financial in the U.S., Pursue is renowned for the huge actual impact, wide Atm community and you may available customer support. If you’d like the idea of earning cash straight back on your requests and wish to get a simple five hundred, this can be an excellent checking choice for you. Your won’t end up being billed overdraft costs and you can be able to access your paycheck two days very early.

To get more to the card’s advantages and you will professionals, listed below are some the writeup on the fresh Bluish Dollars Popular Cards. You’re able to get greatest now offers on the Bluish Dollars Common if you’lso are ready to appear up to. These offers might not nevertheless be readily available, and then we haven’t any treatment for hook up to him or her. In addition to, score a great debit cards you can utilize anyplace Bank card is approved — on the internet and abroad.

Specific banking companies merely allows you to hold a certain number of the notes at once and can refute your for those who’ve removed so many cards within this a short span. For those who have removed several the new cards has just, you might have to waiting a while prior to moving to the some other greeting incentive. The fresh cards may possibly not be good for each day play with, since there’s a good six,100000 cap to the joint orders for the the casual bonus kinds of food, gas and food. And also the best entry to which credit’s rewards is actually for future remains within the brand name, that is restricting if you’d like to branch away and you can try other places. To not getting missed is the credit’s annual 100 percent free evening work with, good to have a-one-night resort remain at a home having a great redemption peak up to help you thirty five,one hundred thousand items.